dallas county texas sales tax rate

2021 Tax Year Rates. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected.

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Contact the Customer Care Center at 214-653-7811 Monday through Friday from 800 am.

. Ad Solutions to help your business manage the sales tax compliance journey. The sales tax rate for these counties is 0 however the Dallas and Dallas MTA sales tax rates are 1 and 1 respectively meaning that the minimum sales tax you will have to pay in these four counties and the city of Dallas when combined with the base rate of sales and use tax in Texas is 825. Dallas County is a county located in the US.

Lowest sales tax 625 Highest sales tax 825 Texas Sales Tax. There are a total of 998 local tax jurisdictions across the state. The current total local sales tax rate in Dallas County TX is 6250.

2020 rates included for use while preparing your income tax deduction. The dealer will collect motor vehicle sales tax from the purchaser when a motor vehicle is purchased from a dealer in Texas if the motor vehicle has a gross weight of 11000 pounds or less. The city of Von Ormy withdrew from the San Antonio MTA effective September 30 2009.

Please view our latest quarterly newsletter the TAX STATEMENT at your convenience. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805. The unincorporated areas of Bexar County.

The dealer will remit the tax to the county tax assessor-collector. If you need access to a database of all Texas local sales tax rates visit the sales tax data page. As of the 2010 census the population was 2368139.

214 653-7811 Fax. You may also visit one of our many convenient Tax Office locations. This rate includes any state county city and local sales taxes.

You can print a 825 sales tax table here. Texas has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 2. Dallas County TX Sales Tax Rate.

1639 rows 2022 List of Texas Local Sales Tax Rates. Texas has 2176 special sales tax jurisdictions with local. The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas.

There is no applicable county tax. Texas has 2176 cities counties and special districts that collect a local sales tax in addition to the Texas state sales taxClick any locality for a full breakdown of local property taxes or visit our Texas sales tax calculator to lookup local rates by zip code. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax.

Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax. Average Sales Tax With Local. The latest sales tax rate for Dallas County TX.

Tax Office Past Tax Rates. If you have questions about local sales and use tax rate information please contact us by email at TaxallocRevAcctcpatexasgov. The latest sales tax rate for Dallas TX.

Notice of Tax Rates Form 50-212 Tax Rate and Budget Information Tax Code 2618 For more information related to Dallas County tax rates please visit the Dallas County Tax Office website. The city of Fair Oaks Ranch withdrew from the San Antonio MTA effective September 30 2008. The December 2020 total local sales tax rate was.

The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas. Learn how Avalara can help your business with sales tax compliance today. Name Local Code Local Rate Total Rate.

DC College District. Dallas TX 75202 Telephone. The Dallas County Tax Office is committed to providing excellent customer service.

The total sales tax rate in any given location can be broken down into state county city and special district rates. It is the second-most populous county in Texas and the ninth-most populous in the United States. The tax is a debt of the purchaser until paid to the dealer.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. Help us make this site better by reporting errors. BalchSprings Dallas Co 2057119 020000 082500 BayouVista Galveston Co 2084205 017500 080000 BalconesHeights Bexar Co 2015030 010000 082500 BaysideRefugio Co 2196031 010000 072500.

60 Day Burn Ban in Effect as of June 23 2022. Dallas County is a county located in the US. The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Dallas local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 825. Name Local Code Local Rate TotalRate Name Local Code Local Rate TotalRate. Always consult your local government tax offices for the latest official city county and state tax rates.

Truth in Taxation Summary. The Dallas Texas sales tax is 625 the same as the Texas state sales tax. 2020 rates included for use while preparing your income tax deduction.

TEXAS SALES AND USE TAX RATES July 2022. For tax rates in other cities see Texas sales taxes by city and county. 214 653-7888 Se Habla Español.

A private party purchaser. This rate includes any state county city and local sales taxes. As of the 2010 census the population was 2368139.

Integrate Vertex seamlessly to the systems you already use. Maintenance Operations MO and Interest Sinking Fund IS Tax Rates. The Dallas Texas sales tax rate is only.

Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum sales tax rate in Dallas County is 625 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in Dallas County.

Texas Sales Tax Rates By City County 2022

Hotel Property Tax Consultant Savings

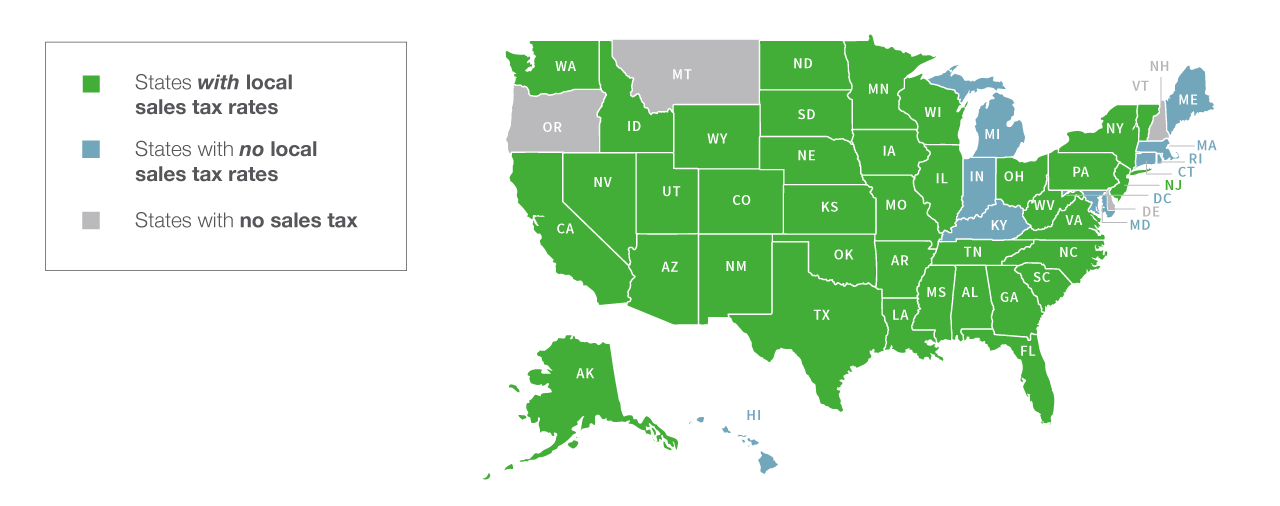

How To Charge Your Customers The Correct Sales Tax Rates

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Texas Sales Tax Rate Changes January 2019

How To File And Pay Sales Tax In Texas Taxvalet

Texas Sales Tax Guide For Businesses

How To File And Pay Sales Tax In Texas Taxvalet

How To File And Pay Sales Tax In Texas Taxvalet

How To File And Pay Sales Tax In Texas Taxvalet

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Cypress Texas Property Taxes What You Need To Know

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

Texas Sales Tax Guide For Businesses

Worksheet For Completing The Sales And Use Tax Return Form 01 117